BNPL, Consumer Finance, and Installment Payments

Buy Now Pay Later is having a volatile 2022 and the year is only half way through. News has been upsetting and surprising at the same time. Swedish BNPL player Klarna’s valuation dipped from $46 Billion to $6 billion while it was forced to lay off 10% of its work force. Zip, another player in the BNPL space pulled out of its acquisition deal with Sezzle. Regardless, Apple announced the launch of Apple Pay Later on June 6th which will allow users in the US to pay for purchases in four installments over six weeks without being charged interest or other fees.

According to Pew, a report by Accenture, a global research firm, showed that the number of buy now pay later users in the United States grew by more than three-fold per year since 2018, reaching 45 million in 2021. Klarna boasts on its website that it has 147 Million global users and 400,000 retailer partners. Afterpay claims 19 Million active users. Affirm, another large player in the BNPL space has 13 million active customers, 210,000 merchants and, a $13 Billion global volume. Sezzle reports 3.4 million users and 47,000 merchants while Zip has 11.4 million global users with 86,200 merchants according to its website.

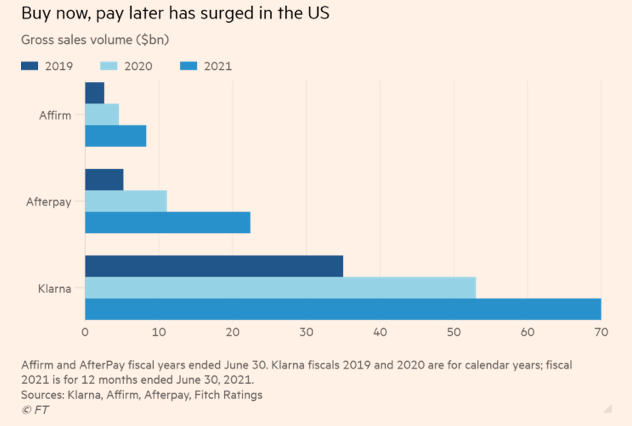

The Financial Times graphic below clearly shows how quickly the volumes on BNPL have increased.

These developments eventually attracted the attention of the Consumer Financial Protection Bureau of the US. Its director, Rohit Chopra who was appointed by President Biden in September 2021 said his agency will “have to take a very careful look at the implications of Big Tech entering this space”. He was already onto BNPL and had asked in December last year for Afterpay, Affirm, Klarna, PayPal, and Zip to provide information about fees, underwriting practices, and credit reporting. It is not only US Regulators of course. EU prepared a report about consumer finance including BNPL in April this year. In June the UK Government laid out plans to strengthen rules on BNPL services to protect users of the short-term credit. Australia was the breeding ground for BNPL and as Australians spent AUS$12 on BNPL in 2021 with almost 6 million active accounts (Australia’s population is 26 Million), the Australian Federal Government is expected to introduce regulation soon.

For a few readers who haven’t heard the concept yet, BNPL is the new buzzword in Western Societies for merchants offering to extend and split payments over a period of time. In fact, banks in many developing countries have been offering such facilities for the past couple of decades. 25 to 50% of card transactions in those countries (i.e. Brazil, Turkey, Mexico, Israel…) carry some form of installment facility. And yes, they are called installments, not BNPL.

Whatever the name may be, the idea is a noble one. Extending some payments over time helps both the retailers and consumers to create more commercial activity.

Yet, BNPL in its current form is far from perfect. It can be offered to finance wrong sorts of purchases, does not necessarily take the consumer’s full credit exposure into account and is sometimes used for very small purchase amounts.

But before we go into that, let’s make a comparison between good old consumer finance and BNPL. Consumer Finance was more developed in continental Europe where payment cards were mostly used as debit or delayed debit and the revolving credit facility on credit cards was not popular. As there is always demand for easier payment forms, some banks, some retailers, and in some cases, banks and retailers coming together started Consumer Finance companies. Findomestic and Cetelem, both owned by French Bank BNP Paribas, are the two big European Consumer Finance companies that have been active since the early 1980s. Before being forced to dismantle its financial arm in the 2008 crisis, GE with its GE Money division was very active globally in consumer finance in the 90s and early 2000s. For a long number of years, most CF companies lacked a well-designed technology infrastructure to operate and simply offered desks/kiosks at retailer sites to help consumers get loans fast. The thing most CF companies did right was that they reported their loans promptly provided there was a credit bureau in that country. The thing most of them exploited was the interest rates on them, especially if there was a default on payments (you could easily see 50 to 60% APRs whereas central bank policy rates were around four to five percent at most).

Naturally, their technology had evolved over years but they did not see much need to innovate especially on small loans and instead found growth on car loans and bigger ticket items. Interestingly they went into revolving credit cards to handle smaller amounts.

The new players of the BNPL world having no legacy to be constrained by approached things differently:

- Rather than applying an interest rate to the consumers, BNPL players cut deals with the retailers and have the merchants pay for BNPL offers rather than consumers.

- Being latecomers, they embraced e-commerce. Rather than having kiosks at physical locations, the BNPL offer was at retailers’ website check-out. As they were financial technology firms, they were able to develop IT systems to integrate with the e-commerce check-out processes. BNPL offers were visible and started to be utilized by consumers rapidly as shopping on the internet constitutes 20 to 25% of all card transactions in many countries. Meanwhile, this emphasis on e-commerce enabled BNPL companies to cut down on the costs of expensive distribution systems bypassing physical retail locations.

- They were not owned by the banks; hence they were able to “shop” for the best financing options from different banking entities.

So far so good, right? Consumers must be happy to have more options to pay with no interest, retailers have an additional sales option, and these BNPL firms seem like tech-driven lean organizations open to innovation. Even if the BNPL industry is just a glorified version of Consumer Finance, is there anything wrong with it?

All is true…except in finance (read offering financial products) you need to do everything consistently right. Yes. Everything. Consistently. Right.

Most startups operate under tremendous pressure from their investors to grow fast, very fast. To achieve such growth rates newly formed BNPL firms wanted to provide their services in multiple countries as many retailers operate globally through e-commerce. Hiring globally while keeping the high quality of the work force is always an issue. More BNPL companies emerged putting more pressure on growth. The retail finance and payments world may seem global but are more local than most tend to believe. The standards may almost be global yet you still need local interfaces. Regulation and consumers’ habits differ highly from country to country. The quality and the quantity of the information on credit bureaus also vary immensely.

Having to grow very fast under more competition and going into markets they do not know as much as their home markets finally placed BNPL players under the spotlight.

One vulnerable area has been credit background checks. BNPL players claim that they have state-of-the-art underwriting systems. Their systems may be state of the art but they only work as well as the information in them. Many countries’ credit bureaus accumulate negative data only for instance. Meaning if someone does not default on a loan, then he will not be in that data warehouse. Therefore, the decision maker to extend a new loan to that person will not get a full picture of the individual’s total debt exposure. Others may have limited coverage for payment cards in their country. Most European countries have the habit of using cards as payments not as credit hence the data about daily transactions are not available. Some credit bureaus don’t cover GSM and other utility bills. Even the most known credit bureaus have been calculating their scores based on the same formula for years now:

- credit history -whether there has been a payment default in the past (35%),

- credit or limit utilization ratios (30%),

- length of credit history (15%) and

- new credit applications (10%).

Years of digitization have created additional information and data, however, we have yet to see any real advances in the way consumer financial scores are produced.

Meanwhile, we see more seasonality, more immigration and mobility, and more people joggling more than one job in our societies today. Such changes in social behavior make evaluating individual credit risk more difficult. “Locking” people into certain zip codes and professions do not necessarily produce expected results. Nor is ethically right. Therefore, if a BNPL/Consumer Finance company is moving into a new country, the black box of decision-making that was created for their home country will hardly produce correct forecasts.

While the press and the regulators rightly discuss requesting BNPL loans regularly be reported to national credit bureaus, they must also question the company level decision-making process for underwriting these loans. The so-called “black boxes” of decision-making hardly produce consistently great results as we sadly observed in the 2008 financial crisis and high-frequency trading.

Another criterion for a prudent BNPL offer is the reason for “borrowing”. Does the consumer want to buy a TV set or is she “financing” an expensive dinner? Is it something that the user will enjoy for at least several months hopefully a number of years or is it being consumed almost overnight or in a couple of days? With the pressure to grow fast, some BNPL firms started to offer financing options for almost anything. (What strikes me is that banks like Chase or American Express, to compete with BNPL players now offer to extend payments next to almost any item done with card transactions if it exceeds a certain amount. Terms like “eligible for plan” or “split it” is displayed if you had an expensive dinner with your bank card.)

Needless to say, the speed of consumption of a certain item, and the need for financing are negatively correlated if you want to be a prudent lender.

It wasn’t long ago that slices of pizza sold with BNPL by Zilch in the UK created a public backlash. On their web-sites, BNPL companies advertise splitting amounts like $100, whereas both in the UK and the USA, the average credit card transaction amount is already $60. Why would you pay back a $100 purchase in four weeks when you already have a grace period of 45 days on the average with your credit card?

The last area of concern when you have pressure to grow fast is transparency. Although most BNPL players claim that they have no fees for consumers, there are some, as they should be for certain reasons. Like for late payments and no payments. These need to be clear and well communicated.

BNPL was not imported from Mars. It came about for a reason. And that reason is a valid one. Customers in many countries need cheaper and more convenient ways to pay. As price increases make life more difficult for people around the globe, this need will become even more imminent.

As explained above, there are some areas that BNPL offers need to improve upon;

- Credit underwriting policies and reporting

- Types of transactions financed

- Average amount financed

- Duration of financing

- Transparency for fees and terms

The following set of rules can be seen as common sense recommendations for a more financially healthy and sustainable BNPL business model:

Credit underwriting policies and reporting: All such loans should be reported to credit bureaus. Regulators must ensure that BNPL players check CB scores and data before every loan decision. Regulators should also ensure that the internal scoring matrixes of BNPL players (the so called black boxes) reflect the realities of the local markets and take into account additional available data on consumers. For instance, why not initiate a state of the art, API driven, real time updated BNPL data sharing?

Types of transactions financed: No perishable and fast consumed items should be financed. In this category, you can easily include groceries, gas, food, dining out and alcohol. Financing these items is an invitation to excess debt and eventual financial misery.

The average amount to be financed: The amount subject to financing should not be less than several times the average credit card transaction amount. As an average purchase amount is $60 in the US, then BNPL should not be offered for less than, say three to four times of that value, like $200. Smaller financed amounts are more difficult to track and recall and could lead the consumer to forget and default on such amounts. The core of any financing is to facilitate commerce. We don’t need very small amounts to be financed for that, especially in Western societies.

Duration of financing: The weekly approach for loan repayments can also be misleading. Paying in four bi-weekly payments sounds very attractive especially for consumers who get their paychecks bi-weekly. Yet our minds are very much wired for monthly planning. Almost all other repeating expenses are monthly, the majority of people budget in months, card and utility statements arrive monthly, and so on. When you introduce a bi-weekly schedule into this, as there are not sufficient tools for the consumers to keep track of these amounts, it eventually becomes a burden that could more easily lead to payment default. If the amount is small and can be paid back in two months, then “should there be financing” is the right question. “Yes if the customers need it” is the easy way out. In our financial world, we need responsible and prudent lenders. Leaving such easy-to-implement guidelines behind almost always ends up in social distress.

Transparency for fees and terms: Needless to say, all the fees that may apply to consumers and retailers should be not in the fine print but clearly communicated and reasonable.

Now let’s move to the last part of our BNPL discussion and close the bridge with installment payments. Let me repeat what I said earlier: BNPL was not imported from Mars. It came about for a reason. And that reason is a valid one. Customers in many countries needed cheaper and more convenient ways to pay. As price increases make life more difficult around the globe, this need will even be more imminent.

It must be no coincidence that most BNPL companies emerged from countries where the banks were not in the installment business. (Only Affirm is San Francisco based and founded by Max Levin an American-Ukrainian software engineer who also started PayPal in 1998. Of the two pioneers of BNPL, Klarna is Swedish, and Afterpay is Australian.) Or for that matter, you could also say BNPL picked up in countries where banks were nowhere to be seen at the point of sale. In 2018 when I wrote ‘Book of Bonus” I explained the reasons why most western banks were behind their emerging market counterparts in payments innovation. One reason I argued was their business model of having issuing and acquiring lines separated. Ignoring the acquiring side of the business, US banks could not introduce innovative services at the point of sale whereas most banks in emerging markets operate on both sides of the value chain hence had the chance of finding solutions to the issues retailers faced through the point of sale software developments and more control of the customer experience at the check-out.

The way installment payments work in most markets is the following: At the time of payment with a card, the POS terminal prompts the cashier and/or customer to show the availability of an installment payment option. Say, for example, a consumer is in a store to purchase a winter coat for $500. With the flexibility at the point of sale, she can choose to pay in five monthly installments and the POS receipt will clearly reflect that. Almost all cashiers and consumers in those countries are aware of this type of payment option as many retailers advertise it heavily for years now. The transaction then will come to the issuer side in real time and if approved, the available limit of the credit card will be adjusted down by $500. This is done to avoid a debt trap should there be many such payments on the card. The issuer will pay the acquirer the whole amount of $500 and in most cases the merchant will get the full amount minus the commission rate. There are instances where merchants also get paid monthly for installment amounts. When the cardholder gets her first monthly statement, she will see $100 payable for this month. She should also see the entry enriched with a description such as “1/5” indicating that it is the first payment of five installments. When she makes the payment, the available limit is adjusted upwards by $100 to reflect the payment. When she completes the fifth installment payment five months later, her limit will have been adjusted back to where it was before the winter coat purchase. Let’s analyze this process more closely:

- The offer will go to someone who already has a credit card and is in good standing.

- The bank that issued the credit card is aware of the transaction and has the option to approve or decline it.

- As part of the regular credit card reporting, the transaction is disclosed and shared with the Credit Agencies automatically.

- Cardholder will see the installment sale with sufficient information on her monthly credit card statement.

- If something goes wrong with the sale, the cardholder has regular dispute channels available.

- Merchants have the ability to operate the POS terminal with several monthly installment options (i.e. three to 12 months) rather than being locked in a predetermined number.

- Fees, if any, are more transparent as they are clearly printed on the sales draft that the POS terminal produces at the time of the purchase.

When you compare this process with today’s BNPL, which model seems better for all parties? I guess we can all agree that it is the installment payments. Then why is it not being developed in the US and some other Western countries? Here you go, another list:

- Almost all POS terminals are controlled by large acquirers and not by the banks. These processors have legacy (read dated) systems that are difficult to change.

- The programmers in those companies have never done it before and would need detailed specifications.

- The product managers who will prepare those specs will need approval from various departments like compliance, legal, finance and so on which will prove very difficult to obtain unless a clear and persistent demand is there to create a sound business case.

- Similar process is true on the issuing side. To accommodate the changes coming from the acquiring side, the issuing software also needs to go through some minor changes. (i.e. recognizing the installment transaction, adjusting the available to buy, and modifying clearing files.) Of close to one billion cards that are in circulation in the US, almost all are processed by a handful number of processors. These large companies go through the same process as the above.

- Their customers, the issuer banks should clearly demand such changes.

- The issuer bank’s product managers need approval from legal, risk, finance, and most likely from some other innovation/digitization steering committee whose members have not heard of or experienced installment payments.

Most bankers will question whether this new payment form will decrease their revolving credit interest income. The answer is no as proven over and over, but it will be very difficult to convince that person in charge of pricing or budgeting as he does not have prior knowledge of installment payments. I can perhaps help by pointing out two areas of possible additional revenue. When there are more useful features on credit cards, more people will use credit instead of debit increasing both the interchange and the interest income. The other additional income source is on the merchant side. Retailers will be willing to pay a higher rate for getting those postponed payments at once.

Like many other strategic issues big companies debate, payment innovation is subject to internal politics and is difficult to execute in a very fragmented world of payment systems. It is therefore only normal that new companies like the BNPL players fill the gap as the need is there.

Let’s hope as they expand fast, they manage to adhere to the principles laid out in this paper. Because the personal pain of financial burden does not stay limited to those people and is often felt throughout the society with unpleasant ramifications.