Spin and Win!

How to sign up for myGini

Explainer video for downloading myGini, signing-up and linking your cards to start earning cash. Watch in 60 seconds.

How to sign up for myGini

Explainer video for downloading myGini, signing-up and linking your cards to start earning cash. Watch in 60 seconds.

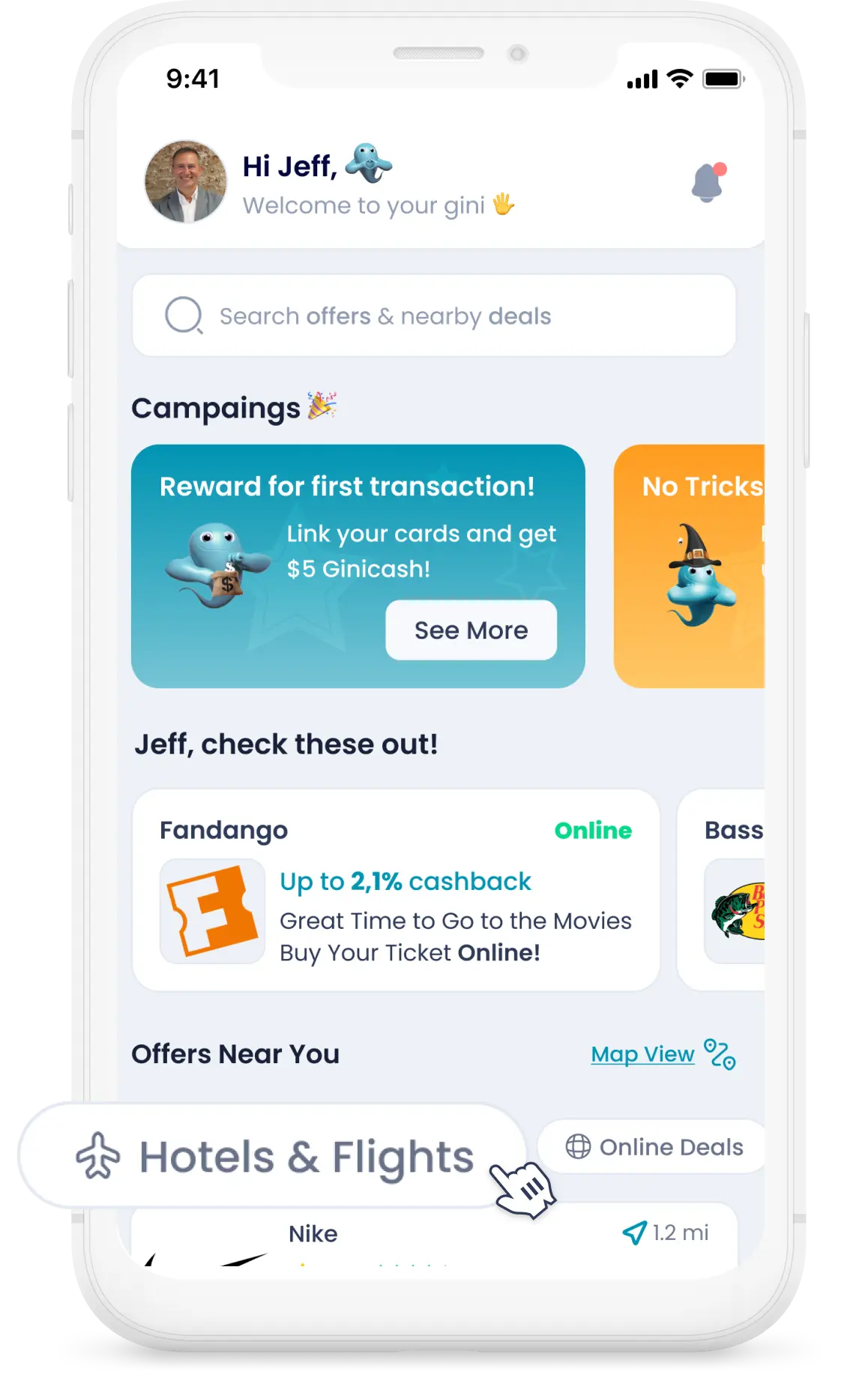

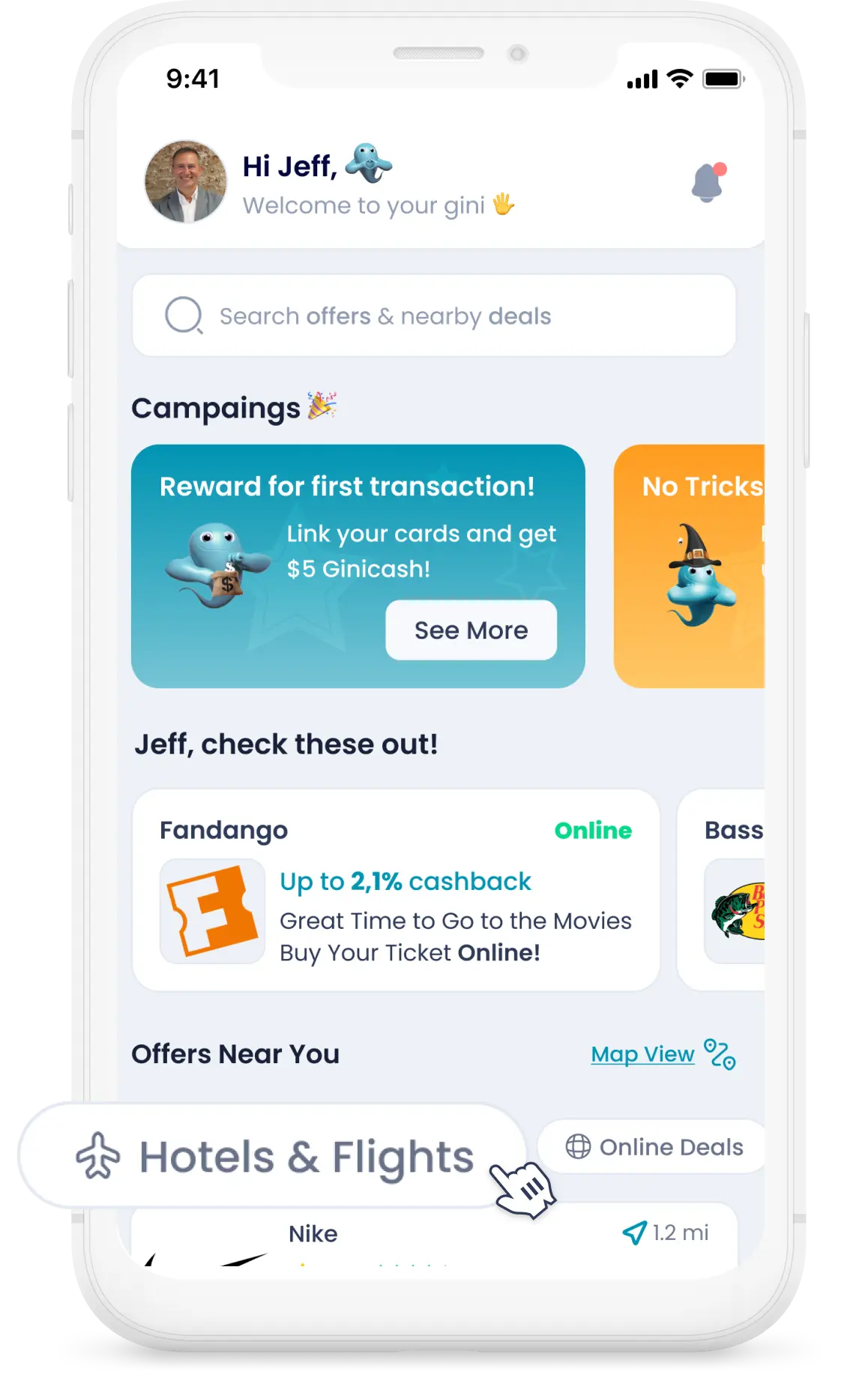

Let’s make shopping fun

Let’s make shopping fun

Great cash back offers from

myGini works like magic!

Great cash back offers from myGini works like magic!

Link

Link

Download the myGini app and link your Visa and Mastercard debit and credit cards. Earn an additional $9 when you make your first purchase. Signing up is free and takes seconds.

Download the myGini app and link your Visa and Mastercard debit and credit cards. Earn an additional $9 when you make your first purchase. Signing up is free and takes seconds.

Shop

Check the app for the best offers near you or for online deals. Then shop as you always do. The cash back will come to you automatically like magic.

Check the app for the best offers near you or for online deals. Then shop as you always do. The cash back will come to you automatically like magic.

Redeem

After each $10, you will get an email to redeem your cash for thousands of brands. You can even chose to donate to a cause you support.

After each $10, you will get an email to redeem your cash for thousands of brands. You can even chose to donate to a cause you support.

Instant cashback from local community shops.

Instant cashback from local community shops.

myGini works with over 20,000 retailers which are already in your community.

The app even shows them within your 20 miles radius.

myGini works with over 20,000 retailers which are already in your community.

The app even shows them within your 20 miles radius.

Magical Cashback Coming Your Way

Get instant notifications and cash with myGini. Watch in 30 seconds.

Magical Cashback Coming Your Way

Get instant notifications and cash with myGini. Watch in 30 seconds.

Offers from the national brands that

you already know and shop will also be there.

Offers from the national brands that you already know and shop will also be there.

7000 Brands for Online Shopping

Online shopping earns you loads of cashback. Watch here to see how easy it is.

7000 Brands for Online Shopping

Online shopping earns you loads of cashback. Watch here to see how easy it is.

Going somewhere? Save hundreds of dollars immediately!

Going somewhere? Save hundreds of dollars immediately!

Just click on the Hotels and Flights and open up a world of travel. Domestic or International. Hundreds dollars of cash back will come to your card directly. Let myGini spoil you.

Just click on the Hotels and Flights and open up a world of travel. Domestic or International. Hundreds dollars of cash back will come to your card directly. Let myGini spoil you.

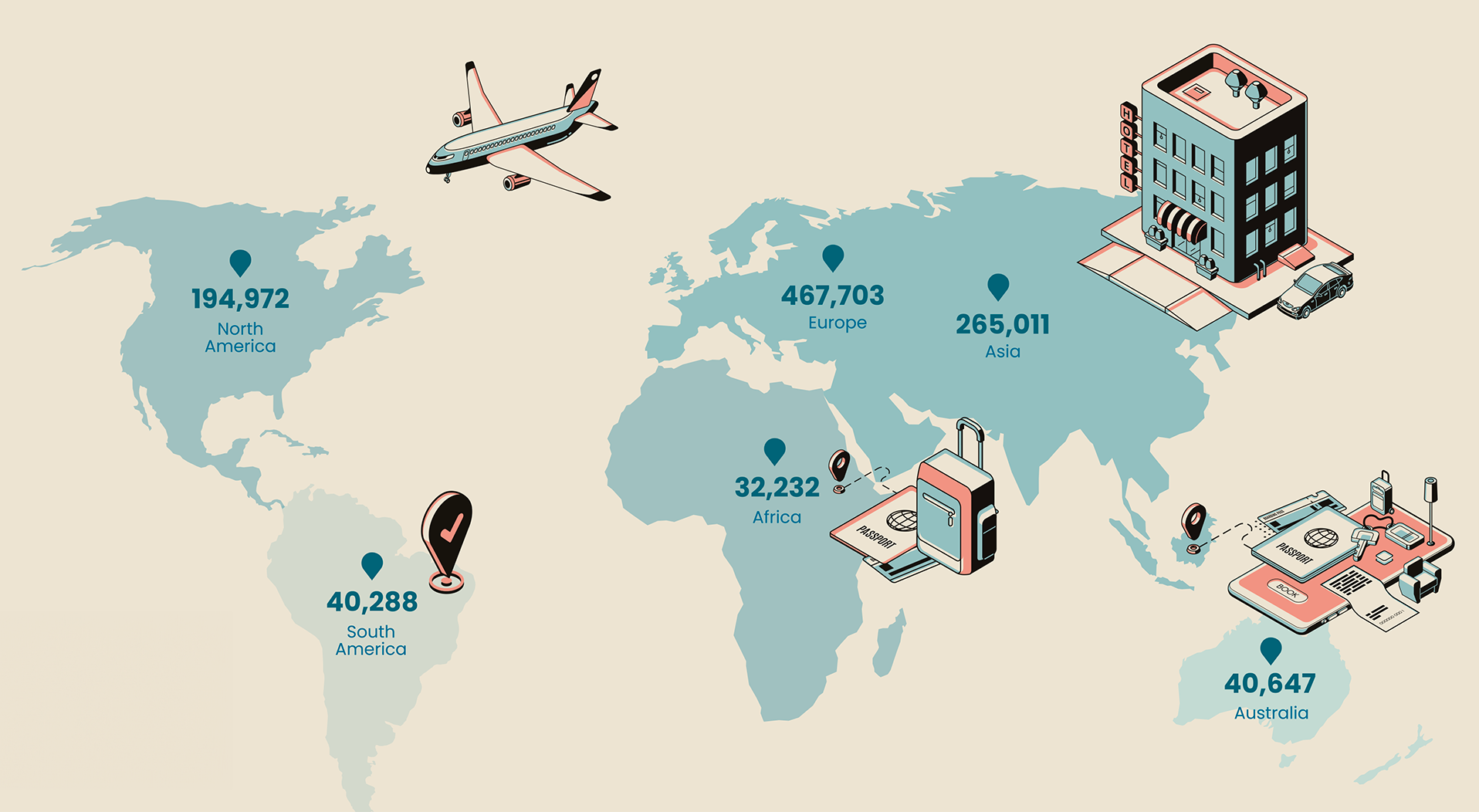

myGini International Hotel Network

myGini International Hotel Network

Total Hotel/Resort Destinations by Continent

Total Hotel/Resort Destinations by Continent

Amazing Cashback from Hotels and Flights with myGini

There are over 850,000 hotels and deals available with myGini. Watch this video to learn how you can get hundreds of dollars of cashback easily. (Plus, you can get cheap flights to where you want to go)

Amazing Cashback from Hotels and Flights with myGini

There are over 850,000 hotels and deals available with myGini. Watch this video to learn how you can get hundreds of dollars of cashback easily. (Plus, you can get cheap flights to where you want to go)

myGini gives you peace of mind with real

time notifications!

myGini gives you peace of mind with real

time notifications!

See the Offers

See the Offers

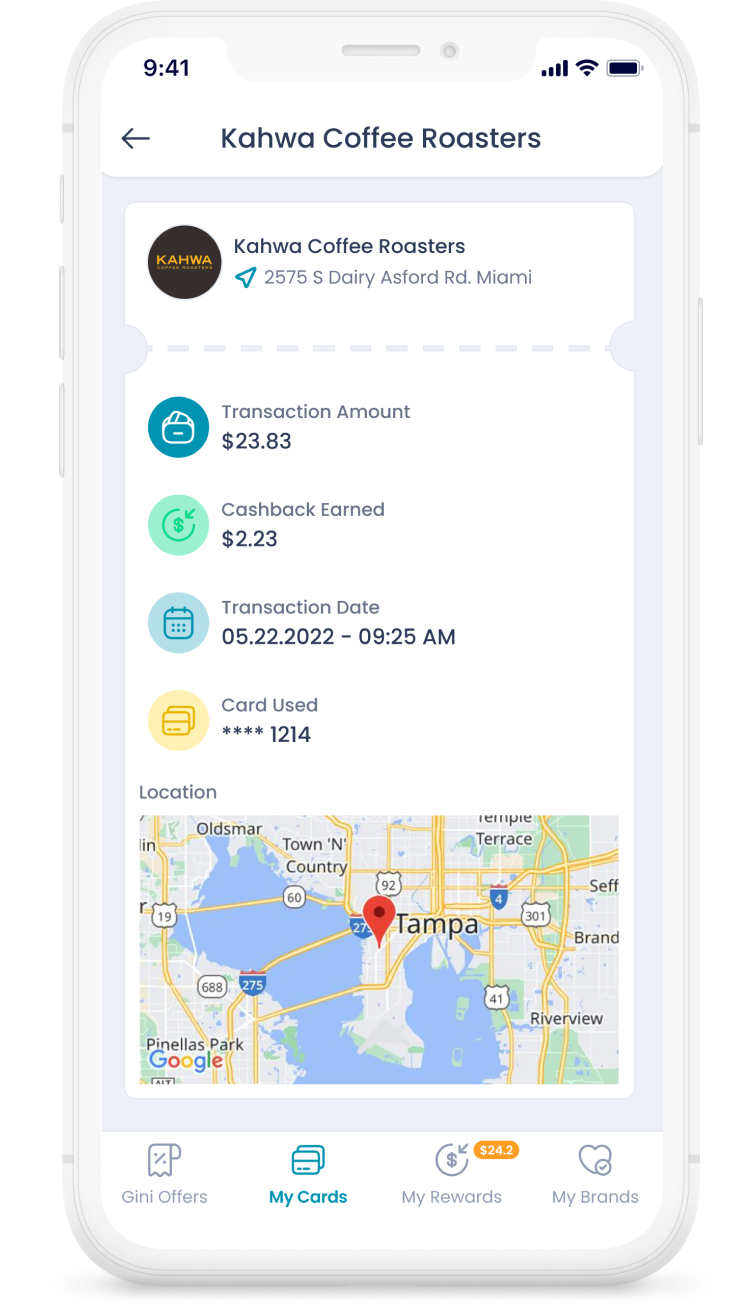

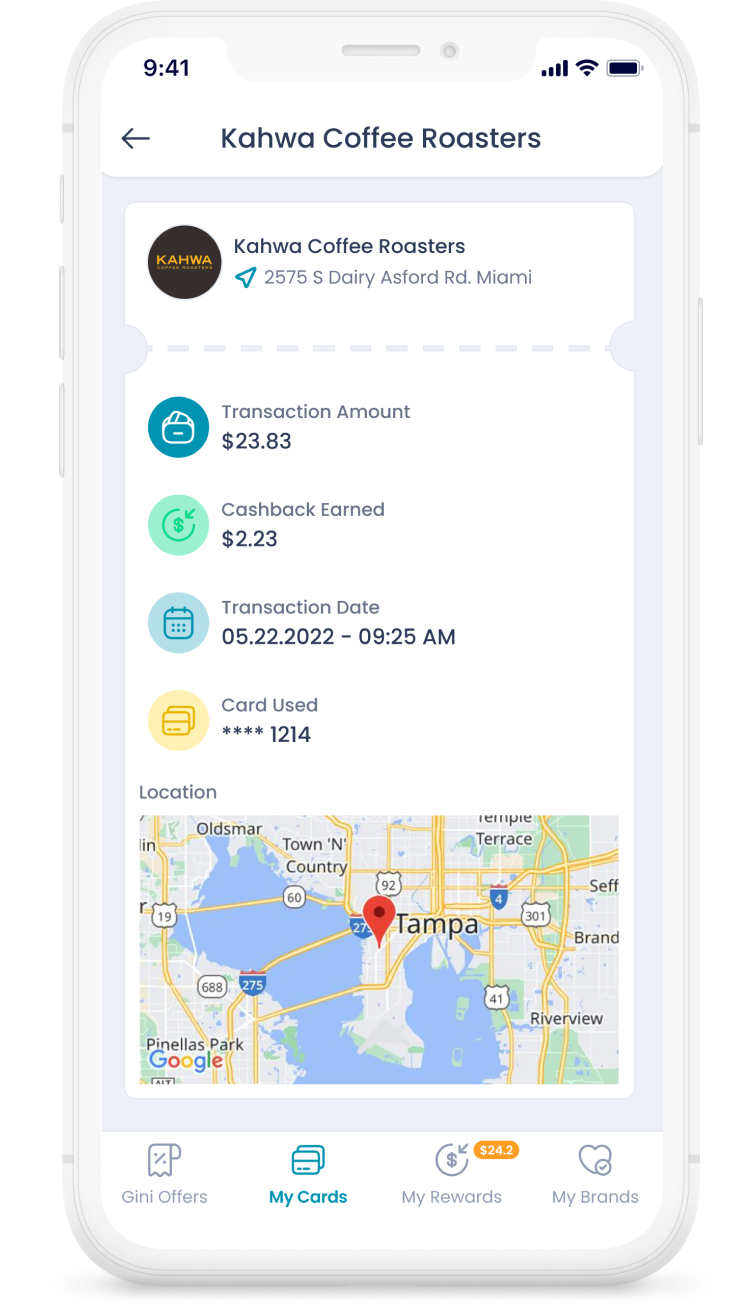

The App opens with the cashback offers around you, wherever you are.

The App opens with the cashback offers around you, wherever you are.

Purchase

Purchase

Just use one of the cards you linked at one of those locations.

Just use one of the cards you linked at one of those locations.

Get Notified Instantly

Get Notified Instantly

You’ll immediately see what you earned. That’s it.

You’ll immediately see what you earned. That’s it.

redemption is automatic with

myGini!

redemption is automatic with myGini!

Cashback adds up fast with myGini.

Cashback adds up fast with myGini.

Your cashback from hotels goes straight back to the card you used.

For all the others, when your rewards reach $10, we send you an email for redemption. You don’t need to ask for it. We do that automatically for you.

The email contains a link to hundreds of digital gift cards from your favorite brands. From Amazon to Starbucks. Select one and it will tell you how to redeem it. You can even choose a charity to donate your cash.

Your cashback from hotels goes straight back to the card you used.

For all the others, when your rewards reach $10, we send you an email for redemption. You don’t need to ask for it. We do that automatically for you.

The email contains a link to hundreds of digital gift cards from your favorite brands. From Amazon to Starbucks. Select one and it will tell you how to redeem it. You can even choose a charity to donate your cash.

Rewards Redemption is like Magic with myGini

Cashback adds up fast with myGini. We send you your cash everytime you reach $10 via email for redemption. You don’t need to ask for it. Watch the explainer video in 30 seconds to see how easy to redeem your cash.

Rewards Redemption is like Magic with myGini

Cashback adds up fast with myGini. We send you your cash everytime you reach $10 via email for redemption. You don’t need to ask for it. Watch the explainer video in 30 seconds to see how easy to redeem your cash.

myGini is determined to keep

your data and your cards safe!

myGini is determined to keep your data and your cards safe!

Your Security Always Comes First

Your Security Always Comes First

We host our platform on Microsoft Azure Cloud and deploy the highest security standard for card transactions called PCI Level 1. Few payment companies have such level of security. PCI DSS compliance ensures adherence to the set of policies and procedures developed to protect credit, debit and cash card transactions and prevent the misuse of cardholders’ personal information.

myGini has achieved the standard, which is required of card brands processing more than 6 million transactions a year. Sensitive information is always kept with bank level encryption. As such, no one has access to your card data including us working at myGini.

We host our platform on Microsoft Azure Cloud and deploy the highest security standard for card transactions called PCI Level 1. Few payment companies have such level of security. PCI DSS compliance ensures adherence to the set of policies and procedures developed to protect credit, debit and cash card transactions and prevent the misuse of cardholders’ personal information.

myGini has achieved the standard, which is required of card brands processing more than 6 million transactions a year. Sensitive information is always kept with bank level encryption. As such, no one has access to your card data including us working at myGini.

Your Data is Never Sold to Anybody

Your Data is Never Sold to Anybody

We do not sell any information; we do not operate on a business model of selling any information. We only share your card information with Visa and Mastercard in a highly encrypted format as required by them to be able to receive your transactions when you shop at any participating merchant. That’s how we know you are eligible for a cashback reward.

We do not sell any information; we do not operate on a business model of selling any information. We only share your card information with Visa and Mastercard in a highly encrypted format as required by them to be able to receive your transactions when you shop at any participating merchant. That’s how we know you are eligible for a cashback reward.